Bushel 2023 State of the Farm Report Highlights and Analysis

Highlights and analysis from Bushel's recent farmer survey

Bushel released their 2023 State of the Farm Report this week.

The survey is well-done and delivers some insights into how farmers think about various topics such as grain marketing strategy, technology use and more. I only cover a portion so I encourage all who are interested in any of those areas to download the entire report.

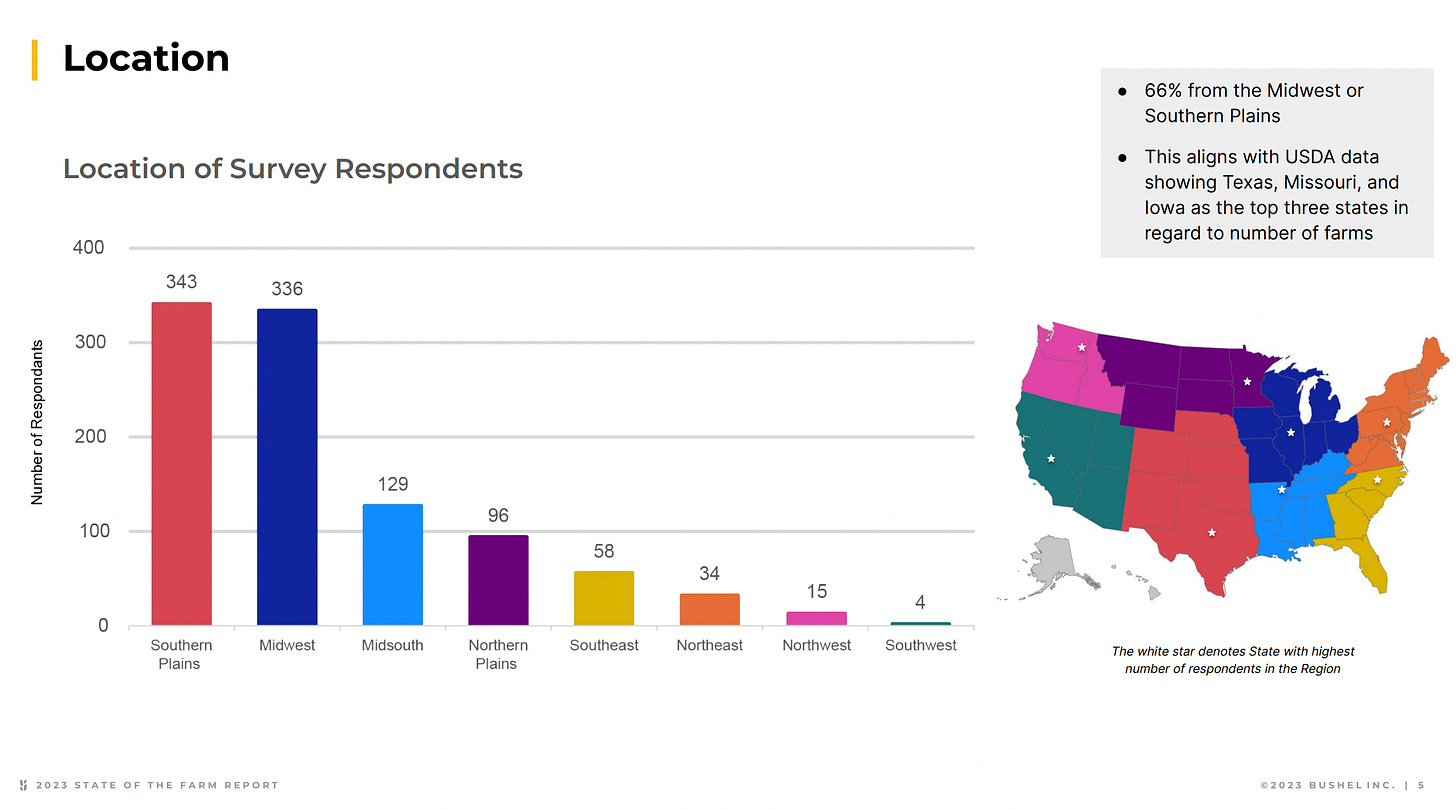

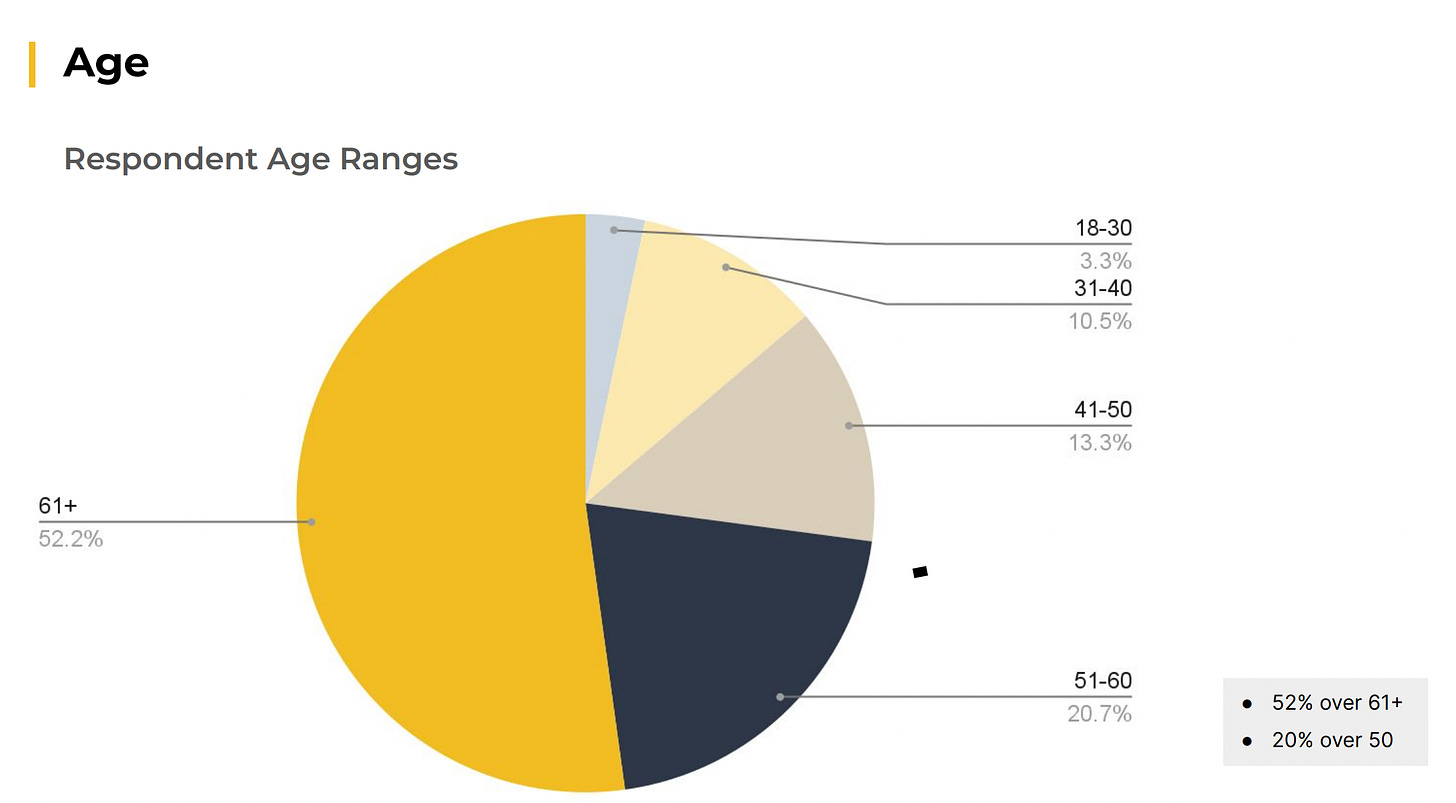

As with any online survey targeted at farmers, it selects for skews in a more progressive direction than what might be the norm. With that said, they do draw from a large array of ages, farm sizes and geographies:

Software

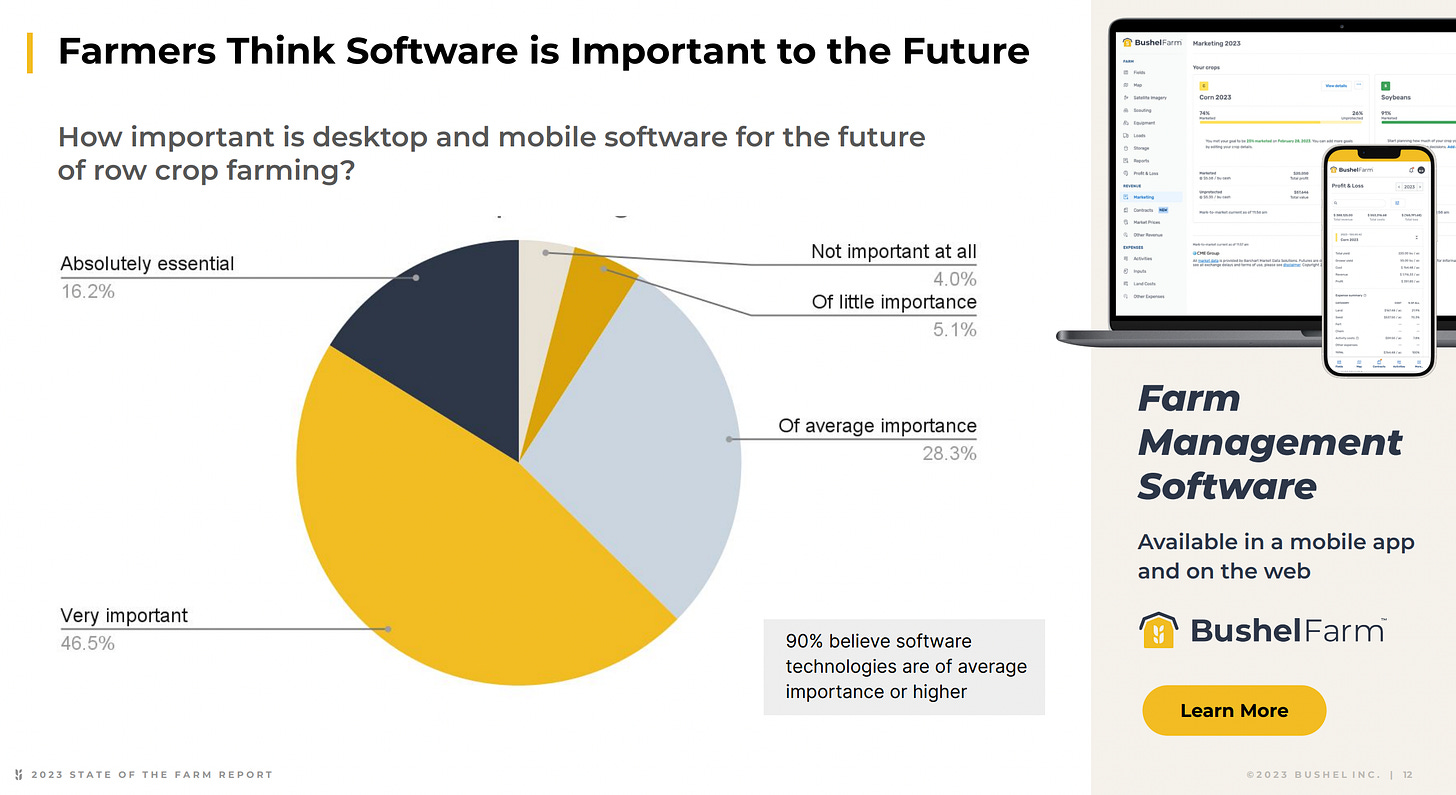

The survey shows that 90% of farmers think software is of average important or absolutely essential:

The question is not how I would have asked it— when you ask people to think about the future they are always more likely to put an increased importance on something than they really think because they are uncertain, so they default to what they have heard. I would have preferred to see them asked how important software is to them in achieving profitability in 2023 as a baseline and then had the future-facing question.

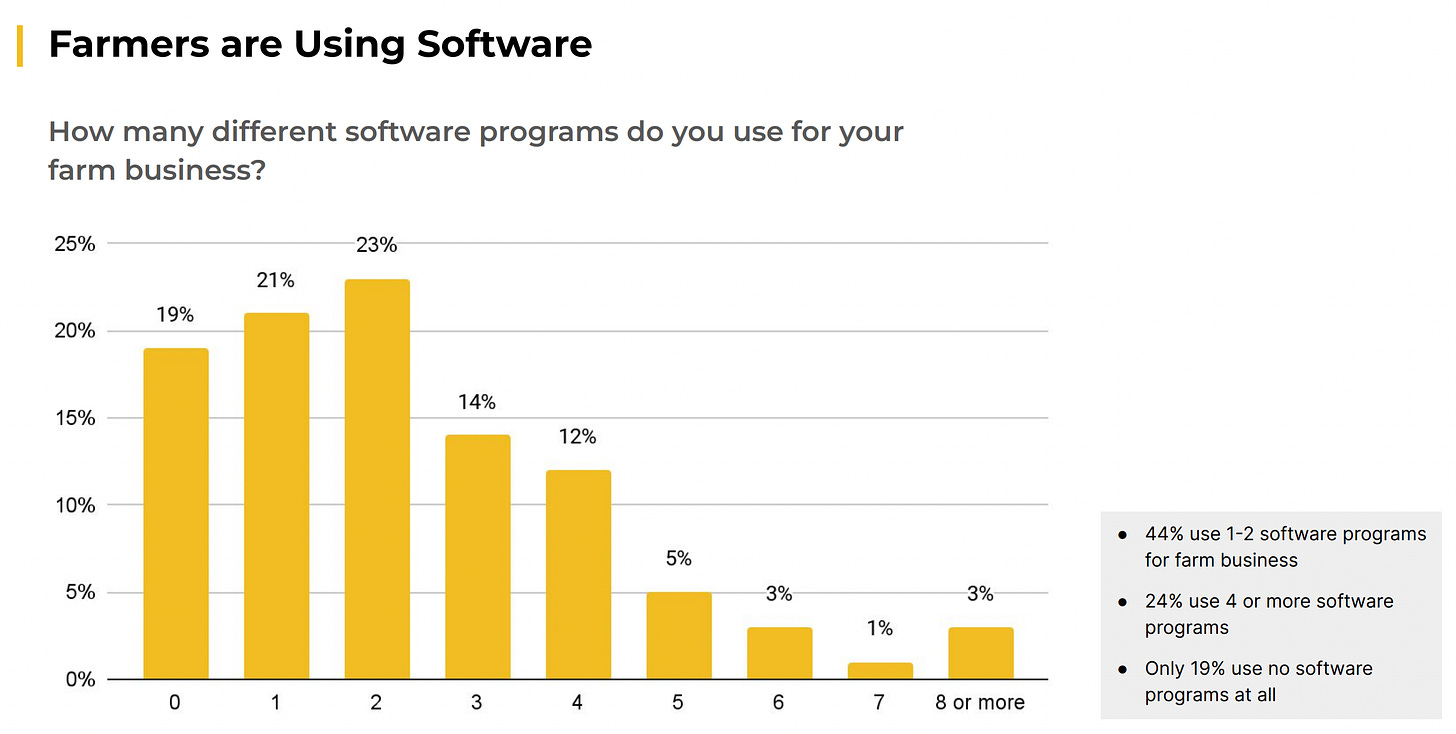

I am always curious how this gets interpreted, but the number that stands out to me is that 20% do not use any software for their farm business. It seems much higher than I would have anticipated for 2023:

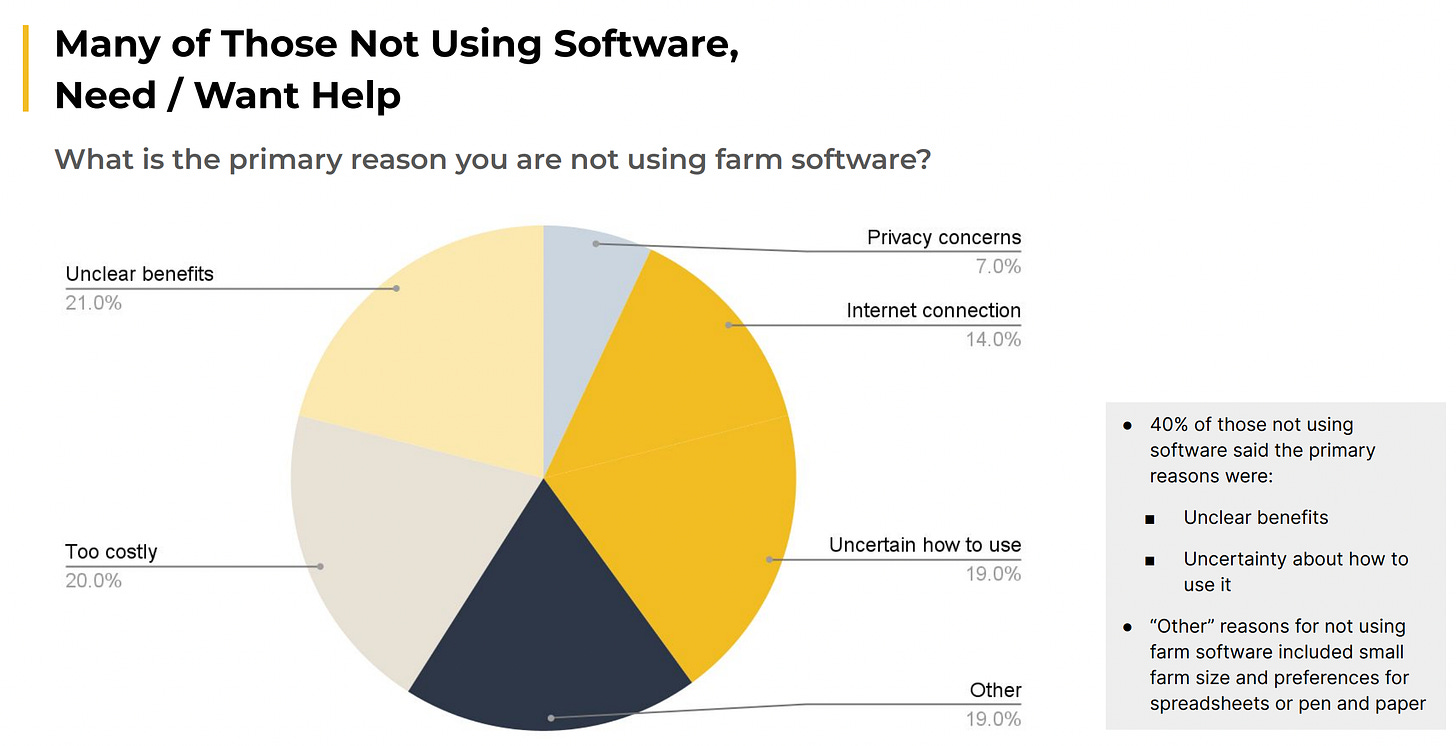

The rationale for not using the software includes:

Grain Marketing

The below chart is a well-constructed question and visualization that delivers a keen insight— knowing your cost of production and using it to guide grain marketing actions leads to a higher satisfaction with grain marketing outcomes. We know planning is important and it shows through in this image— granted it isn’t profitability

This is illustrative of the value Bushel and Bushel Farm can provide when you combine those two things plus the ability to act all in one place:

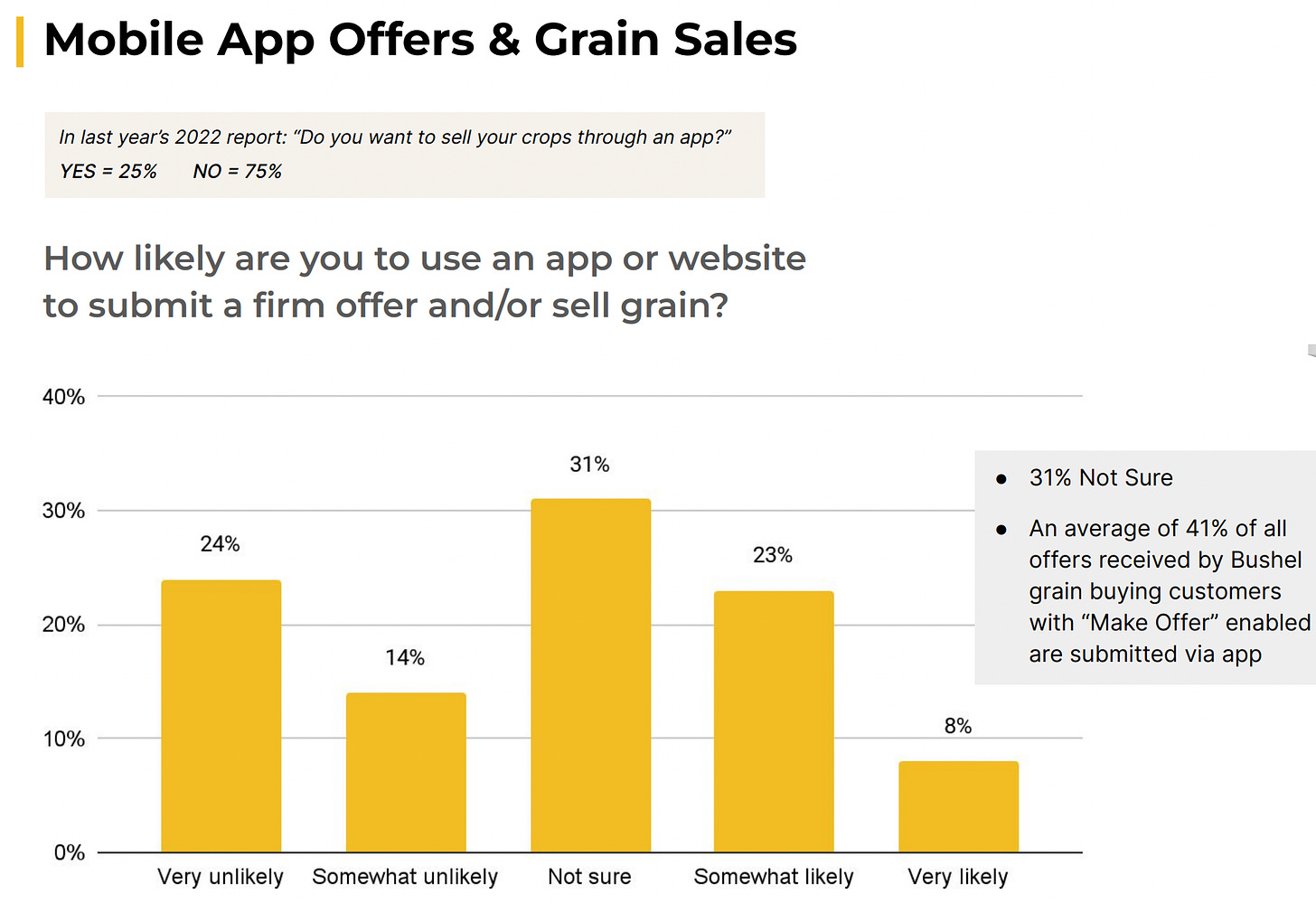

The below provides a good foundation for how farmers think about selling grain online or via an app:

I would be curious to find out what would sway the farmers to sell online— is it a lack of tools? Is it a lack of confidence in being removed from the grain merchant? Is it an aversion to online in totality? I suspect Bushel got some of this information in doing the survey, but only release portions of it for marketing purposes and used the rest as insights internally.

That number will need to grow. Bushel’s business model and long term prospects rely on it. I highlighted this two weeks ago in Bushel Creates Automated Contract Entry in their Farm Management Software: