Welcome to the 35th Edition of Upstream Ag Professional

Index for the week:

Nutrien 2023 Annual Report Highlights and Analysis

GenerativeAI Strategy in Agriculture: Can We Learn Anything from Farm Management Software?

Telus Explains Proagrica Acquisition, The Future of Digital Ag Platforms

The State of Soil Testing

Rantizo® Introduces AcreConnect™ Software

Syngenta Crosses 100 million Digital Hectares

Brainpower vs. Horsepower: An Alternative Future for Ag Equipment

Winfield BioVerified Program

The B2B questions

Upstream Ag LLM Search and Audio Edition

Other Ag Articles

1. Nutrien 2023 Annual Report Highlights and Analysis - Upstream Ag Professional

Highlights:

Nutrien generated net earnings of $1.3 billion and adjusted EBITDA of $6.1 billion in 2023 on $29 billion in total revenue.

Revenue was down 23% from the record levels achieved in 2022 and EBITDA was down 50%.

Over 80% of Nutrien’s retail EBITDA comes from the United States.

Nutrien proprietary products contributed $1 billion in gross margin in 2023, which equated to 23% of total gross margins for the year.

Gross margin for proprietary plant nutritional and biostimulant product lines has grown at a compound annual growth rate of 15 percent over the last five years.

Proprietary seed revenue has grown by over 25 percent since 2021. Almost 40% of their seed gross margin comes from their proprietary seed line.

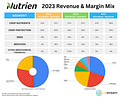

(Revenue and margin as percent of each segment)

The Nutrien business overview includes:

Overview

Nutrien Ag Solutions (Retail) Business

Retail Strategy - Highlight of the Nutrien Retail Strategy

Revenue and Margin Mix by Segment - KPI Chart

Proprietary Products Business - Continued Growth and Focus

Non Financial Metrics - Sustainability and Context

Nutrien Financial - Strategic Leverage Point

Potash Business Highlights

Nitrogen Business Highlights

Other (See and Spray implications on the Business) and Annual Report Stats

Final Thoughts