Upstream Ag Professional - December 17th 2023

Essential news and analysis for agribusiness leaders

Welcome to the 22nd Edition of Upstream Ag Professional!

This is the final edition of Upstream Ag Professional for 2023.

The first edition of 2024 is scheduled to come out on Sunday, January 7th.

Typically, I have done an annual review; however, instead, I will kick off 2024 with areas of the industry I am watching most intently, so expect that in the first edition of the year.

On top, here are a few other small announcements that aim to improve the value of your Upstream Ag Professional membership for 2024:

Beta Launch of Search Functionality - I have partnered with an organization to take all editions of Upstream and create a searchable database to ease navigation of previous editions. The search is equipped with LLM summarization, along with links to the specific editions with the topics you are looking for. Access will be made available for all Upstream Ag Professional members in January 2024. Whether you want to find information about a previous agtech announcement or do a competitive analysis in a segment of the industry, the new search functionality will support that.

Audio Summary of Each Edition - Many have mentioned their preference for audio to stay up on what’s happening in the industry, so moving forward, I will highlight some of the most important events from the week via an embedded audio recording to help you stay informed while you are on a daily commute, or while you do chores around the house.

Regular Podcast - Related to the above, for the past 3 years, I have had regularly scheduled conversations with my friends Sarah Nolet and Matthew Pryor of Tenacious Ventures (and the AgTech So What podcast) where we talk about big ideas in agriculture. We have often said, “We should have recorded this conversation," and in 2024, we will do so on a regular basis, making it available publicly.

Improved Agribusiness Earnings Analysis - Finance is crucial to navigating the real value of ag company strategies or what’s possible from a strategic perspective (eg: acquisitions). I have hired a Chartered Financial Analyst to help me with quarterly earnings breakdowns and annual report analysis, which will improve the comparisons and insights from these company reports. I will also expand the company coverage to more than 30 publicly traded agribusinesses. A full list will be made available in the New Year.

Merry Christmas and Happy Holidays to everyone!

Index for the week:

Bayer's Crop Protection Product Development Report Highlights and Analysis for the Broader Industry

Root Architecture Company Cquesta Raises $5 million Seed Round

European Commission Clears Novozymes, Chr. Hansen Merger

Structure Input Data Consistently with Leaf's New 'Input Validator'

Startup valuation correction will continue in 2024 but worst may be yet to come, say a third of agrifoodtech VCs

EY Food and Agriculture Navigator EY Global Agribusiness 2023 H2 Semi-annual Report

Strategy Tax with Shane Thomas

SFTW Startup Spotlight: TrAIve

Top Ten Articles of 2023

1. Highlights and Analysis for the Broader Industry of Bayer's Crop Protection Product Development Report - Upstream Ag Professional

Key Takeaways

Precision Crop Protection Discovery: Bayer's CropKey represents a shift in R&D, emphasizing molecule design to speed up the discovery of new modes of action and reduce development time and costs.

Biologicals Growth and Open Innovation: Bayer aims for significant growth in biologicals by 2035. Given the low barriers to entry and fragmented bio company/biotech landscape, using an open innovation strategy that focuses on external partnerships for development, indicates a potential trend towards strategic acquisitions to enhance their biologicals portfolio.

Focus on Formulation: Bayer is increasingly prioritizing formulation technology in crop protection, enhancing product performance, molecule delivery and stability, which creates further opportunities for Bayer.

Bayer recently released its report on how they approach product development, from initial R&D all the way to commercialization, including everything in between.

The area of the report I want to highlight is what Bayer calls “the evolution of the discovery process at Bayer”:

New and Selective Modes of Action

Profile-based design of new molecules

Biologicals

Formulations

Open innovation, partnerships, and collaborations

In the link, I dive into all subjects as they pertain to Bayer, but also share charts, images, and insights that spread across the industry to Bayer competitors, start-ups, and future events, such as acquisitions and collaborations.

Related: Iktos and Bayer Collaborate for Sustainable Crop Protection - Globe News wire

2. Root Architecture Company Cquesta Raises $5 million Seed Round - Linkedin

Key Takeaways

Influencing Root Architecture: Cquesta uses technology from the Salk Institute to develop plants with deeper roots.

Carbon Sequestration and Market Potential: Cquesta's technology addresses key challenges in the agricultural carbon offset markets, such as permanence risk. By embedding the root trait within commonly used seeds, farmers can achieve additionality without significant changes to their operations, potentially qualifying for carbon credits.

Challenges and Commercialization Prospects: Cquesta aims to commercialize root architecture traits in key crops within three years, focusing initially on crops CoverCress, Canola and sorghum.

Cquesta has licensed technology from the Salk Institute to enable plants to develop deeper roots and express suberin, a carbon-dense, indigestible compound.

The technology is notable for two reasons:

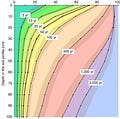

Agronomic Upside: Deeper roots enable a plant to be able to access moisture and nutrients, nitrogen specifically, from deeper in the soil profile potentially increasing yield under drier or nitrogen-short conditions. There can also be some benefits from breaking up soil compaction, as well.

Carbon Sequestration Ease and Durability: Increasing root mass and increasing the depth where those roots are in the soil profile means the potential for increased durability and permanence. The “ease” factor stems from the potential for additionality without a significant systems change to farm operation— simply the farmer opting for a variety with the Root Trait technology in the seed.

In my conversation with CEO Michael Ott, he stated the aim is for yield and quality parity when the trait is used within a variety. Anytime a plant uses more resources to on anything that isn’t the fruit/grain (yield producing), there is a risk of a drag, which will be interesting to watch as this technology is worked on (more below).