- Upstream Ag Insights

- Posts

- Rantizo Raises More than $6 million to Scale Automation Orchestration

Rantizo Raises More than $6 million to Scale Automation Orchestration

An exclusive look at Rantizo's freshly raised capital, a new strategy and a growing area of interest for farmers and the industry.

Key Takeaways

Rantizo raised more than $6 million to scale their leading operator network for spray drone services.

Rantizo connects demand and supply for agricultural spray drone services by selling drones, support, software and training to ag retailers and spray drone operators, and by flying contracted acres for spraying services. Rantizo provides a service platform that can deliver new revenue for ag retailers and seeks to automate spray service delivery.

The future of Rantizo is unlikely to stop at a focus on drones— the future could be the enablement of novel services and business models along with being an orchestrator for the entirety of services and autonomy in agriculture. Subscribe now

Upstream Ag Insights Exclusive on More than $6 million Funding Raise

Rantizo, the leading operator network for spray drone services, announced today an expansion of its oversubscribed funding round. Led by Leaps by Bayer, with Fulcrum Global Capital and Innova Memphis, this round will allow the new executive team to lean into a new growth strategy for Rantizo

A company raising capital at any time is noteworthy. Given the macroeconomic environment and the investors, it is especially notable.

Leaps, being the corporate venture capital arm of Bayer, furthering their investment and Fulcrum Global Capital, being an innovative investment group that has a notable portfolio of drone spraying company Precision.ai and automation company Sabanto.

When I had a conversation with Rantizo about the raise and their new focus in the market, I was enthralled by the evolution of the business:

“Our vision is to build a service network that puts autonomy to work in ag, starting with spray drone services. We are excited to expand our nationwide operator network, deploy our work management and as-applied map software, and continue our exponential growth in acres treated,” said CEO Mariah Scott.

Given this new vision, I wanted to dive deeper into what Rantizo is working toward, how they might spend their new capital raise and look at their business.

In the early days of Upstream Ag Insights, I wrote about my newfound bullishness for drones. Since 2020, even more potential in drones has emerged, as a point of not only data acquisition but also product application— whether crop protection, crop nutrition or planting cover crops, including announcements from the likes of Guardian Ag.

With notable application challenges with large ground sprayer such as compaction, crop trample, expense and inefficiency that can arise in tough-to-get-to areas of fields, geographies or weather conditions, we can see the opportunity for drone spray application services.

The increasing interest in drones for data acquisition and spray application shines through in the number of drones being flown as well. At the end of 2022, there were over 200,000 DJI units alone being used within agriculture on a cumulative area of more than 200 million hectares globally, according to a recent DJI report:

This growth has led to an increase in demand for two things:

Skilled and accredited drone pilots

Software to orchestrate work orders, data and operator acre access.

This is where Rantizo comes in.

Who is Rantizo?

Rantizo was founded in 2018 with the original business plan to build sprayer upgrade kits for drones that utilized electrostatic technology to precisely deliver cartridge-dispensed agrichemicals when and where they are needed.

In 2019, Rantizo became the first company licensed by the FAA to provide drone spraying services in 10 states.

In 2020, the company further diversified its offerings. The Rantizo Fly & Apply platform included a DJI drone, sprayer upgrade kit, Mix & Fill tendering station, Rantizo App and trailer. Rantizo also performed services for its Contractors, handling all the billing, insurance and support needs as well as training.

In 2022, the decision was made to exit the custom hardware lines of business (sprayer upgrade kit, tendering station, trailer).

Efforts were made to focus on compliance services, support and training, packaged with DJI drones, and to sell to large ag retailers who planned to offer spray services.

Mariah Scott joined as CEO in late February 2023, and has focused the company on building an operator network, developing software to automate the workflow of finding, fulfilling and verifying a spray job, and leveraging the contracted acres model to build a two-sided marketplace connecting demand and supply for spray drone services.

Why Drone Services and Spray Applications?

High-clearance ground sprayers are incredible tools for farmers— they are crucial to enabling improved yield and quality for farmers across North America.

However, there are shortcomings of ground rigs— they include:

expensive to purchase and operate

cause crop trample and soil compaction

large leading to challenges in tighter or smaller field areas (eg: around power lines or terraced land)

lose efficiency for spot spray applications (eg: nutrient deficiency management)

cannot be used when soil is too wet

Aerial applicators are great tools too, but they have drift and safety concerns.

These short comings aren’t to say ground sprayers are going anywhere (they aren’t), but it illustrates why there is an opening for drone application.

Drone applicators can overcome all of these struggles.

Drones are still imperfect though too— many crop protection products are not optimized for such low water volumes, there are regulations challenges and the biggest one, their hourly acre capacity is in the 40ac/hr range and on average are in the ~25ac range (for a singular DJI unit) while ground rigs are anywhere from 60-100ac (depending on geography, water volume etc). This is one of the largest challenges to overcome, along with cost.

However, all of these are being worked on via advancing regulations around swarming, battery technology (and more) and because of the alluded challenges in ground sprayer usage, there is momentum for drones to grow.

The Rantizo Differentiator

Rantizo was a seller of hardware.

They are now working to become not only an enabler of drone application but an orchestrator of a two-sided marketplace.

Rantizo is building the necessary infrastructure to orchestrate and optimize the delivery of drone services to farms across the United States.

Rantizo creates and connects demand for acres to be sprayed by drone to a network supply of agricultural spray drone service providers while streamlining the data flow:

Enabling Supply

Rantizo enables the networked marketplace itself by first re-selling drones, support, software and training to ag retailers and spray drone operators and by flying contracted acres for spraying services. Sometimes, these are independent individuals or companies operating the drones themselves; sometimes, it is a Rantizo-owned operation, or sometimes it is ag retailers themselves that spent capital on equipping themselves and their staff with the ability to fly drones and apply crop inputs.

Generating Demand

Rantizo also works with retailers and manufacturers (trialing), for example to create demand for spray services via drone. The Rantizo customer base includes major retailers in the Crop Life 100 as well as major crop input manufacturers.

Streamlining Solutions

The secret sauce really comes in with their software— Rantizo is building the software to dispatch drone operators, manage as-applied data and connect work orders from retailers in an effective way that allows data to go seamlessly from drone to ag retailer for example, allowing for verification of application.

Rantizo also enables a closing of the loop when it comes to the sensing, diagnosing and acting components of the digital agriculture loop:

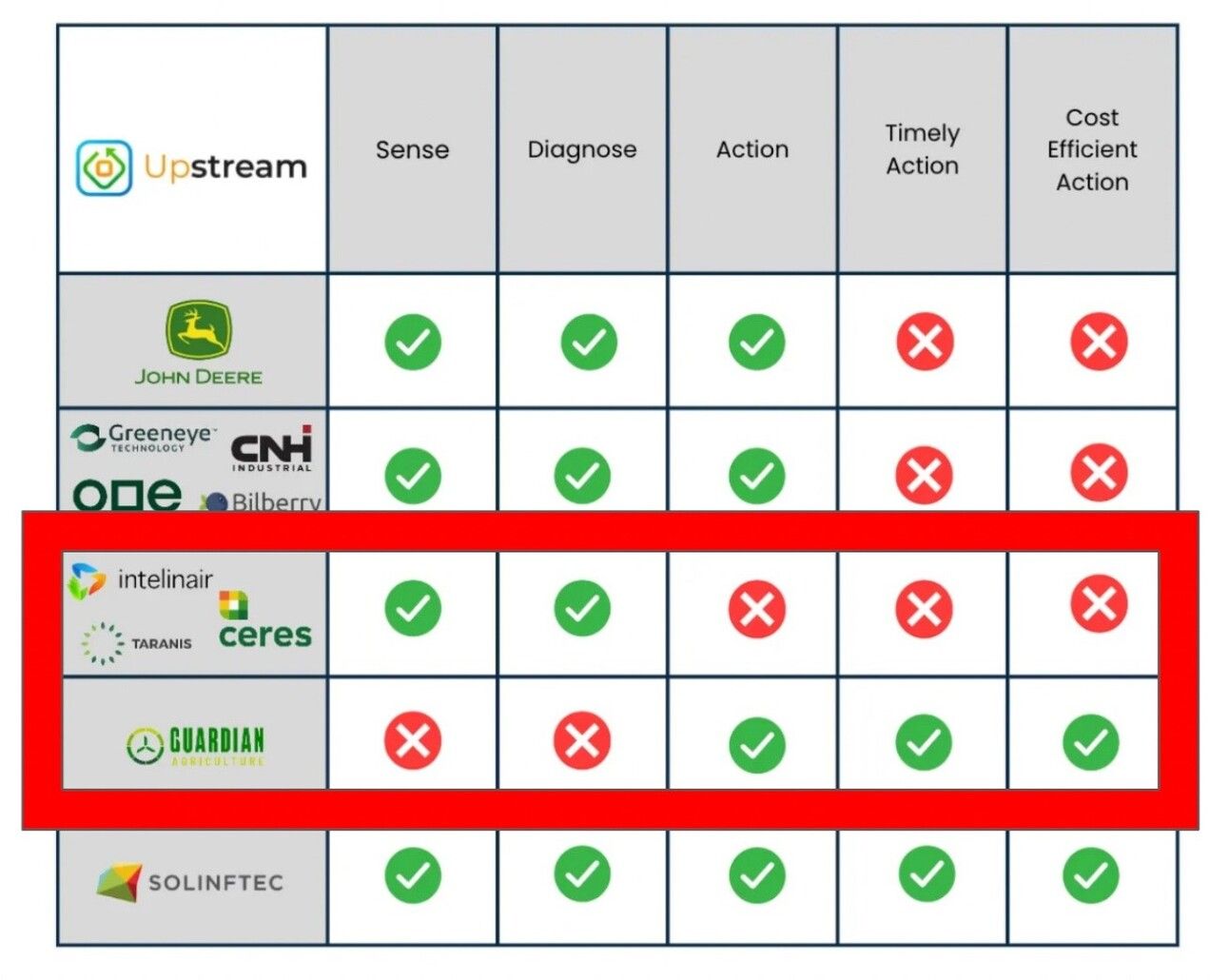

I touched on this recently in The Closed Loop Challenge in Precision Agriculture and Sentera's New Launch of Precision Weed Technology along with more in-depth in Solinftec and the Solix Autonomous Platform: Reimagining Farming from First Principles.

I created a chart illustrating where certain companies fall on the continuum of sensing and action and it becomes notable where opportunities for connection between aerial analytics companies with drone spray applications:

In the Closed Loop Challenge, I highlighted the disconnected nature of sensing and diagnosing , but missing the ability to take action. If there is a drone operator capable of flying the drone to sense and diagnose and then software to take the map to prescription creation and execution, and that drone operator can also fly the spray application, this becomes more compelling.

Rantizo’s data integration platform will work with 3rd party systems to automate workflow between ag retailers and spray drone operators to improve productivity for job creation, dispatch, execution, work verification, and billing. Not to mention, managing the regulatory compliance for drone operators.

Rantizo becomes the infrastructure for all groups wanting to execute a spray application with a drone. They are a data integration platform that automates the workflow for an operator by integrating 3rd party apps, not creating data silos.

This capability stands out to me because of the need for this in retail (as evidenced by the likes of Raven’s Slingshot and John Deere’s new efforts to break further into retail) plus a conversation I had with a large farmer in the PNW last year. This farmer had been using spray drones on his farm for the past few seasons and one of his biggest challenges was finding software that could take as applied data and effectively import/export it to his FMS system.

The Rantizo Network

Currently, Rantizo manages the largest network of spray drone operators in the United States. They operate in 30 states and have over 140 active pilots in the network. In the last year, Rantizo has doubled the acreage flown.

One thing that scares me about marketplaces in agriculture is the disparate nature of the industry— building a business across a wide geography means challenges in connecting demand to supply or supply with demand efficiently because of geographic constraints. This creates poor experiences for both sides. Rantizo is cognizant of this and is prioritizing its efforts in areas that create strategic hubs across the United States, including parts of the mid-west and PNW. This is key for any marketplace to gain network effects and grow effectively.

Rantizo Business Model

It becomes apparent Rantizo does numerous things in the market, but how do they make money?

Historically, Rantizo sold bundled hardware products with services—a customer (eg: independent drone operator, or retailer) had to buy a drone, plus flight operations support, including compliance management for the Part 137 operating certificate. Rantizo has evolved this model— selling products and services singularly.

Today, their revenue breaks out across three segments:

Hardware sales

Rantizo is a reseller of DJI drones and parts where they generate a margin on each unit and accessory sold. This could be to independent drone operators or retailers for example.

2. Certificates, Training and Support

Rantizo has established themselves as a leader in the drone education space and sells training and support to drone operators as well as flight operations support, including compliance management for the Part 137 operating certificate. Rantizo also sells hardware support for drone operators, such as troubleshooting or services to repair drones. This could be to independent drone operators or retailers, for example.

Acre Contracts

Rantizo creates demand for drone application acres. For example, Rantizo might work with Retail A in Washington to generate 25,000 acres of guaranteed acres for their drone network to cover in that area.

The pricing depends on the crop, but ranges from ~$15/ac to ~$25/ac.

Today, in the focused hub areas, Rantizo owns their own assets and has operators employed where they can capture the entirety of the cost per acre as revenue.

As the network gets built out, an independent from the drone operator network could execute the spray service and Rantizo would take a percentage of the per acre price for any acre demand directly generated by them. Given the pace of adoption and the pressure on existing labor at a retailer, Rantizo has shifted the model to sourcing the acres from the retailer and then using their software and service platform to broker the jobs to the operator network.

Rantizo knows that if they can create demand for drone application acres and they can make it easy to get set up with drone application capabilities, their business will grow:

The Future of Rantizo

It is always important to note that much has to happen for Rantizo to scale their business as it is currently. However, if that can be effectively executed, the opportunities for Rantizo are compelling which is why investors like Leaps are continuing to double down on their investment in them.

Services Network and Marketplace

“Our vision is to build a service network that puts autonomy to work in ag, starting with spray drone services. We are excited to expand our nationwide operator network, deploy our work management and as-applied map software, and continue our exponential growth in acres treated” — CEO Mariah Scott.

I emphasized the first sentence because CEO Mariah Scott specifically calls out a move beyond drones in the fund raise press release.

Rantizo wants to eventually expand beyond drones.

Starting with one specific area of autonomy and services is an intelligent approach for building out any market.

A common example is Amazon— they started with the online selling of books, and only books. Founder Jeff Bezos chose books for very specific reasons: they shipped well, the ability to stock every book in a traditional store was impossible, they weren’t perishable and there was a large demand all over the place for literature.

Drones have unique aspects, too— they require special training, they require specific licenses and there isn’t software to support them currently which puts Rantizo in a unique position to enable and orchestrate drones in North America and then expand from there. If they execute surrounding drones effectively, this gives them the foundation to launch new services.

These services could be autonomy-driven equipment services, or could begin to expand into other service areas surrounding agronomic practices.

Given that the connection today is primarily retailers, we can see how Rantizo can actually extend the services they offer and the efficiency with which they execute on those, especially as precision services grow. For example, a retailer might be able to access 3rd party soil sampling services and free up time for their sales agronomists to do more high-value tasks.

Related: My friend Rhishi Pethe recently wrote on the potential of 3rd party crop services to farmers in "Salinas, we have a problem".

Closing the Loop on Crop Health and Crop Protection

One area that we could see Rantizo expand to as well is an ecosystem orchestrator of various other sensors and services.

I have written several times in Upstream about how various technologies and capabilities are converging and the opportunity that creates for many different entities participating in the upstream area of the value chain.

Taking several trends and technologies such as weather sensors and insect sensors (eg: RapidAIM), biologicals and pheromone crop protection products, combining with insurance underwriting capabilities, along with autonomous drones brings forth an opportunity to create an entirely new service that can be sold as an insect free field at the start of the year to a farmer and eliminates the risk and hassle for the farmer of drastic loss to the likes of insects. I talked about it more specifically in this 2021 edition of Upstream.

There are infinite challenges to executing a service like this, but one of the needs is to have an orchestrator of the data flow, including alerts and then the application and the execution. Rantizo is already setting up for this and could be that orchestrator which would make them incredibly compelling in the future.

Final Thoughts

Drones are not mainstream yet. There are challenges to overcome when we think about battery technology, application efficiency per hour and cost to execute. These challenges are being worked on and Rantizo has fresh funds and a new strategy to enable the future of drone utilization and autonomy in agriculture.

The opportunity for Rantizo is large— looking at row crop acres alone, there are more than 250 million in the USA, sprayed several times per season. While it is unlikely that each and every acre transitions from a ground spray unit, it also presents a future opportunity for Rantizo where not only are there multiple spray passes but also harvest, tillage, fertilizer application and planting passes that present opportunity as they work towards their future vision.

Rantizo is an entity that can be a part of shaping the future of precision ag and crop inputs and I think they are worth watching moving forward.

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality