- Upstream Ag Insights

- Posts

- Ascribe Bio Closes $12 Million Series A Financing

Ascribe Bio Closes $12 Million Series A Financing

A look at the raising environment, the product, and what comes next for Ascribe Bio.

Ascribe Bio, an innovator in natural crop protection, today announced the closing of an oversubscribed $12 million Series A financing round, co-led by Corteva, through its Corteva Catalyst platform, and Acre Venture Partners. The financing also included participation from new and existing investors including Syngenta Group Ventures, Trailhead Capital, Silver Blue LLC, Cultivation Capital, and The Yield Lab.

This milestone advances Ascribe’s small-molecule technology platform and supports the upcoming commercial launch of Phytalix®. Phytalix is a revolutionary ‘biofungicide without compromise’ that provides the health and sustainability benefits of biologicals with the ease of use and affordability of traditional chemical crop protection products.

This week Ascribe Bio Closed a $12 Million Series A Round and I had a conversation with Gabriel Wilmoth, COO, of the company.

This week I had a conversation with Gabriel Wilmoth, COO, of Ascribe Bio. Gabriel has a unique experience in that he’s been an investor (Syngenta Ventures), a part of a start-up that was acquired (GROWERS), sits on the board of a rapidly growing biological company (BW Fusion) and now has day-to-day responsibilities at Ascribe Bio. Given that unique experience, our conversation looked backwards 3 years over the company’s development since their Seed financing round, to the current Series A, and highlighted what the fund raising process was like in today’s market. The below is broken down into four segments:

Overview of Ascribe and Phytalix

The Fund Raising Landscape and Process

Ascribe Bio and the Future

Investor Make-up

Overview of Phytalix

Ascribe Bio’s flagship product is known as Phytalix.

Phytalix is a small molecule crop protection product derived from ascarosides, naturally occurring signaling molecules produced by soil organisms such as nematodes— specifically with biofungicide attributes.

Unlike conventional fungicides that directly work on pathogens, Phytalix has a unique mode of action that works by priming the plant’s immune system. Two of the most important plant defense strategies are Induced Systemic Resistance (ISR) and Systemic Acquired Resistance (SAR) — Phytalix leverages these mechanisms.

ISR specifically can be thought of as a natural way of “vaccinating” plants, preparing them to fight off pathogens. Phytalix has shown efficacy on major diseases like Asian Soybean Rust, Northern Corn Leaf Blight, and Fusarium Headblight. Notably, ISR has a broader efficacy beyond fungi, and even supports a plants ability to fend off bacterial pathogens.

Phytlix is effective at low doses, 25-100mg/ac, reflecting its role as a biochemical signaler rather than a traditional killing agent.

The molecule also has versatility. Today, the company has focused on foliar application, but there is potential to be used as a seed treatment, tank mixed, or co-formulated with conventional crop protection products. I think the co-formulation aspect is important, too. It has a unique mode of action and would work well in conjunction with a traditional fungicide to both prime the plant (Phytalix), and stifle pathogens directly (traditional fungicide).

It also has more traditional “chemical-like” IP, including numerous patents and patent filings surrounding the molecule — related to formulation, use case, modified release of the molecule and more.

Fundraising Landscape and Approach

In 2021, Ascribe Bio had a molecule that had seen significant academic research but only one field trial. They knew their future hinged on answering three questions:

Does Phytalix work outside the lab and greenhouse and in the field?

Can it be manufactured at a cost that makes it viable in broad-acre row crops?

Is it safe? And will regulators in the U.S. and Brazil agree?

Over the next three years, Ascribe worked to systematically answer each in hopes of derisking the molecule, and the business.

Over that time frame, they have added more than 800 field trials across multiple countries and independent organizations to learn more about the product and optimize performance.

They were able to get the manufacturing COGS low enough that Phytalix could be used in a row crop setting, with adequate margins for the company and through the value chain. One of the stand out aspects to me here was the dosage requirement — needing just 25-100mg/ac to achieve adequate efficacy. Ingredient potency is one component of delivering manageable COGS, and also enables future optionality for co-formulation or co-packaging.

Ascribe didn’t share their specific cost per gram or per acre, but if it is going to be attractive to crop protection companies, it should be below $2/ac + strong gross margins for the manufacturer (60%+) with the ability to decrease even more at scaled manufacturing. Many effective biocontrol products have been hindered by high costs of production.

The company also advanced regulatory submission in Brazil and the United States, with the potential to be approved in Brazil by end of 2025. A critical milestone that has been accomplished with less than $9 million raised prior to this announcement.

Ascribe worked towards their three priorities, looked at a potential exit, but an exit didn’t come to fruition.

By late 2024, the M&A market for pre-revenue biological assets was non-existent. That drove Ascribe to pivot from an acquisition-ready stance to capital-raising to support the next stages of development.

When the company started fundraising in early 2025, they were focused on proof points. Without the ability for commercial sales to show traction, Gabriel mentioned that investors were specifically interested in the strength of future commercial pathways — such as distribution agreements with the likes of Nutrien.

Investors saw Nutrien’s involvement as tangible validation that Phytalix had a route to market. In the instance of Nutrien, they are specifically in a “joint development agreement and supply agreement” which signals that Ascribe is selling the raw ingredient to Nutrien for them to formulate and produce as a proprietary product offering.

Still, the fundraising process wasn’t quick. Over a seven month timeframe, the team spoke with more than 100 investors and pitched 40+ times, before getting several term sheet offers and ultimately closing the round.

The major factor that stands out to me about Ascribe is focus.

Ascribe has not been chasing every crop or region — even though they show viability as a seed treatment, in numerous crops, more diseases and have a patent application in co-formulations with plant nutrients. They have been disciplined: row crops, specific geographies, and a foliar application method. They have also focused on distribution agreements, selling the active ingredient to the likes of Nutrien rather than formulating themselves or trying to build a sales team and go direct.

Focus reduces burn rate and preserves capital, increasing the potential for an attractive return for investors even if they eventually sell for under agtech’s unofficial glass ceiling of ~$400 million. Notably, the other important number is the cost of bringing a new active ingredient to market, which AgBioInvestor most recent public data cites as $300 million, so you can see where there is a rough cap on exit value, but even after this funding round, Ascribe’s capital investment will be 10x lower.

Acquirers

Ascribe is prioritizing for being sold and is on track to become a nice acquisition target.

Large pharmaceutical companies have used M&A to bolster their innovation for a long time. Crop protection manufacturers seem poised to follow a similar approach, and given the cyclicality in ag and the financial markets, the appetite for M&A will return.

The ag industry has many similarities to Pharmaceuticals. And the current data shows that in the Pharmaceutical industry, over 50% of company revenue did not come from internal innovation — it came from acquired assets or technology brought in through other means (eg: University).

I suspect we will see a similar trend in crop protection, particularly in biocontrol.

If we layer on data from AgBioInvestor that shows crop protection companies have been spending well under 10% of their R&D dollars on biological endeavours, it reinforces that if incumbent crop protection companies are going to bring new bio-based molecules to the market, they are going to rely heavily on external collaborators and acquisitions:

This all suggests the obvious acquirers are major R&D-driven crop protection companies — the likes of Corteva, Syngenta, BASF, and Bayer.

All of them have been investing in and assessing biocontrol, looking for products that combine high efficacy, global potential, low use rate, low cost of goods, low environmental impact and strong formulation/stability profiles.

Corteva and Syngenta stand out given their CVC participation in the round — which would ultimately lower the net cost of a future acquisition (depending on valuation).

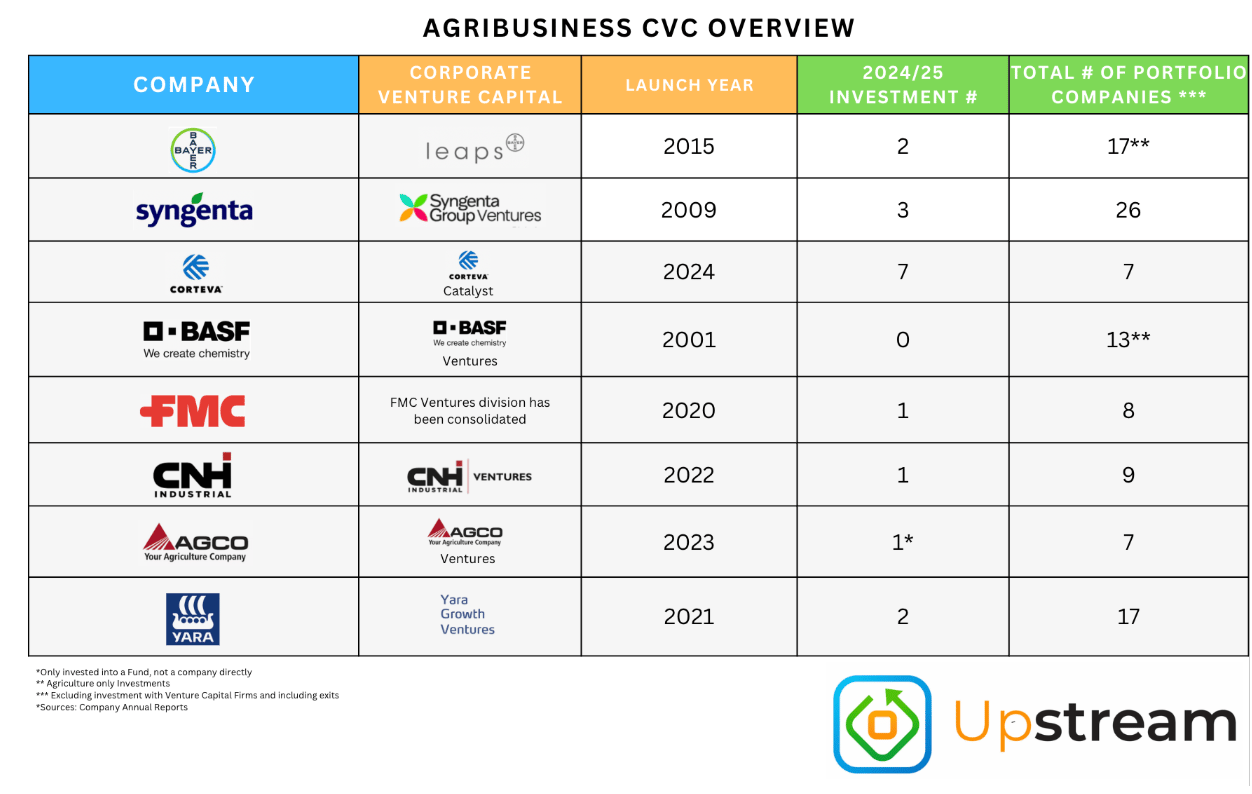

Syngenta hasn’t publicly shared many investments in recent years, with this being only their third public announcement since 2023, second investment announcement of 2025, and first in an entirely new entity:

Note: Public announcements only. Each company could have many other investments.

With Syngenta not being public, it is more difficult to understand some of their nuanced ambitions in various market segments, such as biocontrol. However, I had a conversation with David Pierson, Managing Director of Syngenta Group Ventures, about their participation in the round and one specific comment stood out: the internal investment committee unanimously supported an investment in Ascribe, which provides a signal as to how Syngenta is thinking about the future of its portfolio and biocontrol.

Corteva has strongly signalled a willingness to expand its bio-based portfolio, with their commitment to investing in bio-based entities via their Catalyst platform over the last ~18 months as reinforcement:

The other reason Corteva stands out is that following the Corteva split, the new crop protection-focused entity could benefit from leaning into biocontrol and acquiring biocontrol assets that can augment that segment of their portfolio, along with augment the current synthetic portfolio (eg: co-formulation, lifecycle management etc.)

Large retailers such as Nutrien also present a possible path.

Nutrien has been gradually expanding its proprietary product portfolio, and biocontrols could offer an avenue to strengthen its in-house lineup with differentiated molecules, and has made several aquisitions, including Suncor’s biocontrol assets in 2024 and the $300M+ acquisition of Actagro. One constraint could be that a retailer’s geographic footprint and regulatory capabilities may not match that of a global R&D company or the diversified chemical manufacturers like Sumitomo or Mitsui, which could limit their willingness to pay — or Nutrien might be content collecting multiple distribution agreements with several entities rather than outright owning the asset.

Finally, there is a less conventional category of potential acquirer — formulation and surfactant companies. Stepan, for example, has shown interest in building out full-stack formulation capabilities all the way to the active ingredients, and in biologicals. For these firms, acquiring a biocontrol active could provide unique leverage when partnering with large crop protection manufacturers seeking novel ingredients or formulation advantages.

Final Thoughts

The next few years for Ascribe are likely to be focused on pushing for regulatory approval in more markets, scaling up their manufacturing, building an even more robust data set, and establishing more distribution partners. I will be curiously watching to see if they ever expand into higher value crops, or will remain focused — usually over 60% of fungicide molecule revenue comes from high value crops.

The Phytalix molecule itself could be an ancillary data point of how biocontrol can be integrated into a synthetic world to improve disease control and resistance management, lower environmental impact and improve economics throughout multiple points in the value chain.

Subscribe to Upstream Ag Professional to read the rest.

Become a paying member of Upstream Ag to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A professional subscription gets you:

- • Subscriber-only insights and deep analysis plus full archive access

- • Audio edition for consumption flexibility

- • Access to industry reports, the Visualization Hub and search functionality